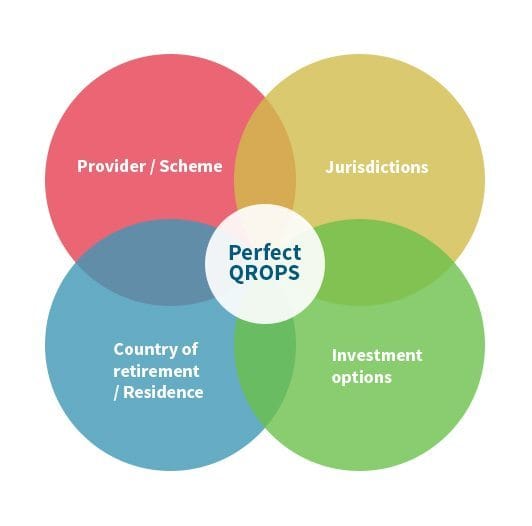

Upon conducting a general study of the QROPS market and the standard of advice given, Qrops.net has identified four important features which, when combined correctly, create the perfect, tailored scheme for the individual.

These are four aspects which are not always given the level of consideration they should be by advisors, however as the client, you should also be aware of the importance each facet represents to be certain that you are placing your funds into the correct scheme.

We consider these four features to be of the most importance. If these aspects are addressed and catered for, the perfect QROPS is created for the individual’s requirements.

Provider/Scheme

The importance of selecting the correct QROPS provider cannot be underestimated. A provider should be researched properly to ensure not only that they meet the HMRC criteria to qualify as a QROPS provider, but that they are a credible organisation with the knowledge, understanding, track record and customer service levels required.

- There are currently 3311 QROPS offered by hundreds of providers across the globe

- Most providers have multiple QROPS options with different levels of flexibility

- All schemes have different fees attached

- Some schemes will allow transfer of a QROPS from a different jurisdiction with no charge

Country of Residence/Retirement

It should go without saying that the country in which you currently reside cannot be the UK, a QROPS is only for expatriates, but how significant is the preferred choice of destination for retirement? Extremely.

The country you intend to retire in must work effectively with the jurisdiction your savings are held in. This is the most important consideration. Of course, there are those of us who are unsure of where we would like to retire, never mind where we actually are likely to, so finding a scheme which does not penalise if a transfer is required, is a good idea.

- Spain, France, Australia, USA and Portugal are among the most popular retirement destinations

- Ensure there is a Double Taxation Treaty

- Consider the Tax regulations on benefits

Jurisdiction

Some people assume that all jurisdictions are the same, this is a serious misjudgement. What differentiates one QROPS jurisdiction from another goes way beyond simple pension legislative procedures. There are varying degrees of commitment to QROPS on both an economic and political level, there is the financial stability of the economy to be considered, and the standard of regulation too.

The jurisdiction must be able to transfer money into the country of residence without severe tax implications to make a QROPS an effective product. For example, most jurisdictions are unable to transfer into the US due to the rigid nature of the IRS’ view on overseas earning. Malta is one jurisdiction which has thrived in the last few years due to their Double Tax Agreement with America, which means that their pension schemes are recognised as non-taxable income. So for those retiring in the States, there really is only one option.

- There are 42 jurisdictions available

- Popular jurisdictions are Ireland, Australia, Isle of Man, Gibraltar, New Zealand and Malta

- Non-qualifying jurisdictions can find all of their schemes immediately removed from the HMRC list

- Variations in respect of lump sum allowances, benefit withdraw dates, investment options, death benefits, tax and retirement ages must all be considered and matched to your requirements

Investment Options

The investment options available vary hugely between QROPS, there are platforms which do not invest any of the funds, they simply hold them until retirement – particularly relevant for those close to drawing on their pension, and there are other funds which invest aggressively with a view to achieving substantial growth upon maturity.

There is no “one size fits all” scenario within the investment aspect of a QROPS. Much will depend on the size of the pension, the lifestyle requirements upon retirement, and the age you hope to retire.

- Providers invest significant amounts in stock market trends and analysis

- Some jurisdictions forbid the saver from making any investment decisions

These four options must be carefully considered, and to build the perfect QROPS, the requirements and objectives within each category must be met.

How can we ensure that these four features are properly catered for by our chosen QROPS? By seeking professional advice!

As a multi-national association, Qrops.net has a global network of the leading consultants across every jurisdiction.

Regardless of the country of residence or the preferred retirement destination, we can offer expert advice and insight into the best QROPS options tailored for the individual.

From ensuring that the correct double taxation agreement is in place in the desired jurisdiction, to making certain that the provider offers a product with the right amount of flexibility and options, we are the proven experts in every aspect of QROPS.

It’s what we do.